Vishal Mega Mart IPO: India’s Largest IPO Opens for Subscription – Should You Apply?

Vishal Mega Mart Limited, one of India’s top two offline-first diversified retailers, is launching its Initial Public Offering (IPO), which opens on December 11, 2024 and closes on December 13, 2024. This ₹8,000 crore IPO, structured as an Offer for Sale (OFS), has generated significant buzz as it surpasses LIC’s IPO in size, making it the largest in Indian market history.

If you’re considering investing in this IPO, here’s everything you need to know.

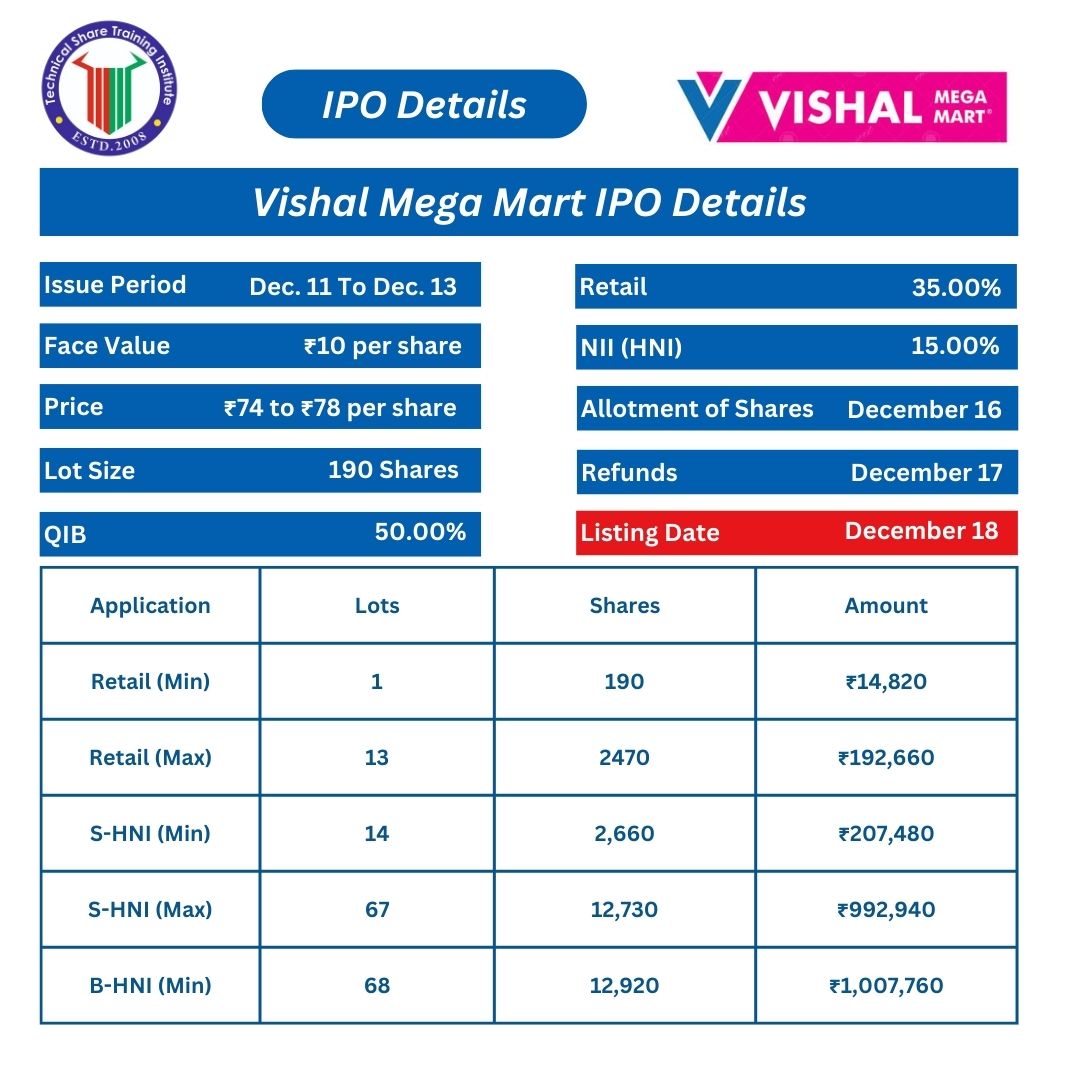

Key Vishal Mega Mart IPO Details

- IPO Size: ₹8,000 crore

- Issue Type: Book Built Issue (Entirely Offer for Sale)

- Price Band: ₹74 to ₹78 per share

- Lot Size: 190 shares (Minimum investment ₹14,820)

- IPO Open Date: December 11, 2024

- IPO Close Date: December 13, 2024

- Listing Date: December 18, 2024 (Tentative)

- Pre-Issue Shareholding: 4,508,719,493

- Post-Issue Shareholding: 4,508,719,493

IPO Subscription Categories

- Qualified Institutional Buyers (QIBs): Not more than 50% of the net offer.

- Retail Investors (RII): Not less than 35% of the net offer.

- Non-Institutional Investors (NII): Not less than 15% of the net offer.

Investment Insights

Lot Size and Investment Amounts

| Investor Type | Min Lots | Shares | Amount (₹) |

|---|---|---|---|

| Retail (Min) | 1 | 190 | 14,820 |

| Retail (Max) | 13 | 2,470 | 192,660 |

| S-HNI (Min) | 14 | 2,660 | 207,480 |

| S-HNI (Max) | 67 | 12,730 | 992,940 |

| B-HNI (Min) | 68 | 12,920 | 1,007,760 |

About Vishal Mega Mart Limited

Founded in 2001, Vishal Mega Mart is a leading hypermarket chain catering to middle- and lower-middle-income households. It operates through a network of 645 stores across 414 cities in 28 states and 2 union territories. Additionally, its mobile app and website complement its Pan-India presence.

- Business Model: Asset-light, with leased distribution centers and third-party manufacturing.

- Customer Base: 6.77 million registered users as of September 2024, serviced across 600 stores.

- Portfolio:

- Apparel: Classics, Fashion, Denim, Ethnic

- General Merchandise: Tandem Home Appliances, Home Select

- FMCG: Staples, Home Care, Savory Products

Strengths of Vishal Mega Mart

- Expanding Consumer Base: Focused on a growing segment of India’s population.

- Diverse Portfolio: A wide range of products across multiple categories.

- Pan-India Reach: Successful track record of expanding store networks.

- Technology-Driven Operations: Enhancing efficiency and customer experience.

- Experienced Management: Professional leadership driving consistent revenue and profit growth.

Objects of the Issue

This IPO is entirely an Offer for Sale (OFS). The proceeds will go to the promoter selling shareholder, and the company will not receive any direct funds from this offering.

Expert Analysis by Sahil Goyal

Sahil Goyal, owner of Technical Share Training Institute, advises:

“This IPO presents a solid opportunity for long-term investors who believe in the growth of India’s retail sector. Vishal Mega Mart’s asset-light model, diverse product portfolio, and Pan-India presence make it a strong contender in the hypermarket space. While short-term listing gains may not be guaranteed due to market conditions, long-term vision can make this IPO a profitable bet.”

Potential Risks to Consider

- Offer for Sale Model: Since no fresh equity is being issued, the company won’t benefit from the proceeds directly.

- Market Volatility: External factors like geopolitical tensions and macroeconomic conditions could affect performance.

- Competition: The retail market in India is highly competitive, with both organized and unorganized players.

Should You Apply?

If you’re a long-term investor, this IPO could be a rewarding opportunity due to Vishal Mega Mart’s strong brand equity, proven business model, and Pan-India footprint. However, ensure that you align your investment with your financial goals and risk appetite.

Final Note: Invest with Knowledge

Investing in IPOs requires a clear understanding of the business, market conditions, and financial goals. To make informed decisions, learn before you earn. Join the Best Technical Share Training Institute today to master IPO investing and stock market strategies.

💡 Empower your financial future—start learning now!

#VishalMegaMartIPO #IPOInvesting #RetailSector #LongTermGrowth #LearnAndEarn #StockMarketInsights #SahilGoyal

Follow us:

https://www.facebook.com/BestTechnicalShareTrainingInstitute