Tata Capital IPO 2025: All You Need to Know Before Applying

India’s financial markets are gearing up for one of the biggest IPOs of the year — Tata Capital Ltd. IPO, a diversified NBFC from the Tata Group. With a strong track record, wide product suite, and robust pan-India presence, Tata Capital’s IPO is creating strong buzz among investors.

Here’s a detailed look at the IPO structure, timeline, strengths, and expert view.

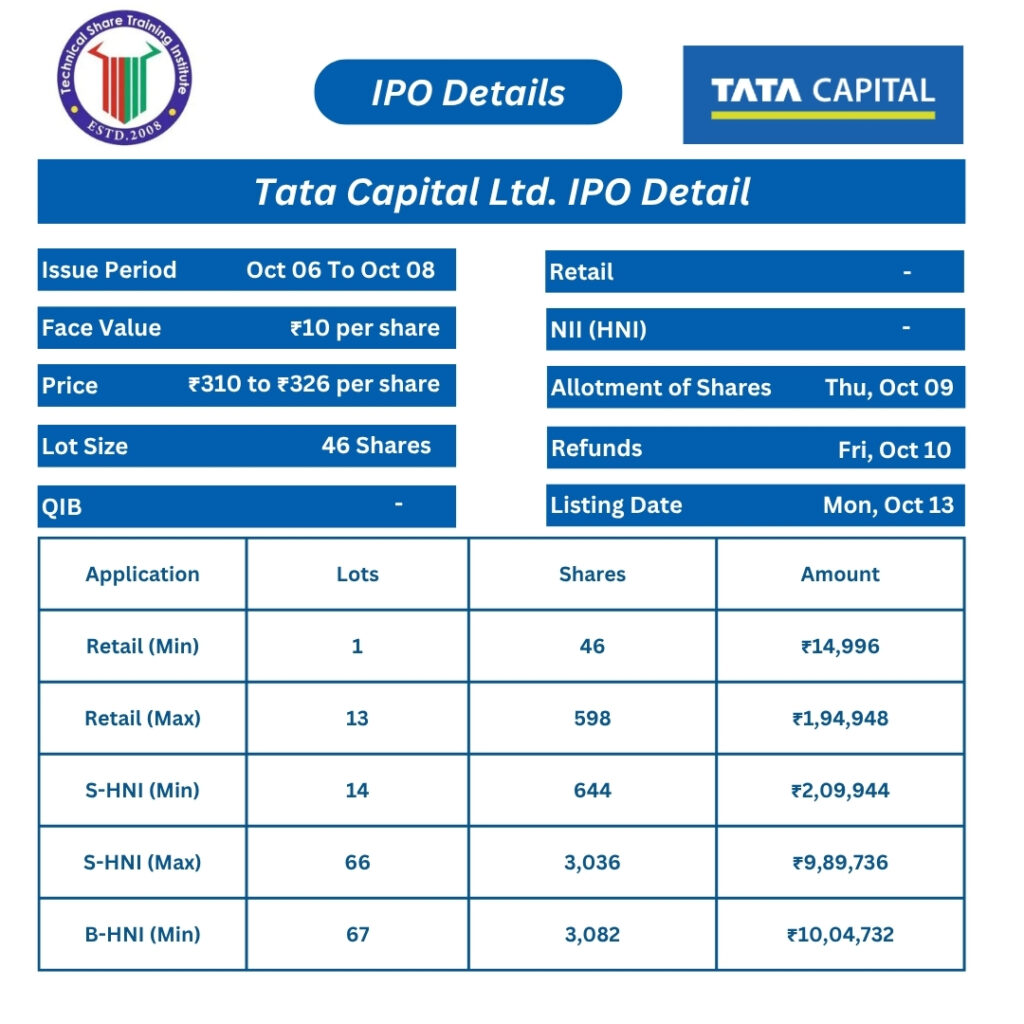

📌 Tata Capital IPO Details

- IPO Opening Date: October 6, 2025 (Monday)

- IPO Closing Date: October 8, 2025 (Wednesday)

- Price Band: ₹310 – ₹326 per share

- Face Value: ₹10 per share

- Lot Size: 46 shares (₹14,996 minimum investment for retail investors)

- Total Issue Size: ₹15,511.87 crore

- Fresh Issue: 21 crore shares (₹6,846 crore)

- Offer for Sale: 26.58 crore shares (₹8,665.87 crore)

- Post Issue Shares: 4,24,48,69,037 shares

- Listing At: NSE, BSE

Tentative Listing Date: October 13, 2025 (Monday)

👉 Registrar: MUFG Intime India Pvt. Ltd.

👉 Lead Manager: Kotak Mahindra Capital Co. Ltd.

🗓️ Tata Capital IPO Timeline (Tentative)

- IPO Opens: October 6, 2025

- IPO Closes: October 8, 2025

- Allotment Date: October 9, 2025

- Refunds Initiation: October 10, 2025

- Shares in Demat: October 10, 2025

- Listing Date: October 13, 2025

🏦 About Tata Capital Ltd.

Tata Capital Limited (TCL) is the flagship financial services arm of the Tata Group and the 3rd largest diversified NBFC in India.

🔑 Key Offerings

- Consumer Loans: Personal, home, auto, education loans & LAP

- Commercial Finance: Business loans, equipment finance, working capital loans

- Wealth Management & Advisory

- Investment Banking (ECM, M&A, structured finance)

- Private Equity management

- Cleantech Finance (renewable & sustainability-linked projects)

📍 Network & Reach:

1,516 branches across 1,109 locations in 27 states & UTs (as of June 2025)

25+ lending products covering retail, SME, and corporate customers

💡 Competitive Strengths

✔ Flagship Tata Group financial services brand

✔ Third largest NBFC with widest product suite

✔ Omni-channel distribution – branches, digital, partnerships

✔ Strong credit profile, prudent risk culture

✔ Highest credit ratings among NBFCs

✔ Consistent profitability & growth track record

✔ Experienced management backed by Tata Group governance

📈 Expert View – Should You Apply?

Tata Capital’s IPO is one of the largest financial services offerings in 2025. With its diversified lending portfolio, strong brand trust, and solid financial performance, the IPO is well-positioned to attract both institutional and retail interest.

- Expected Listing Gain: ₹370 – ₹390 per share range (approx. 15–20% upside from upper band)

- Long-Term View: Positive, considering Tata Capital’s scale, strong governance, and sector tailwinds.

- 👉 Advice: May Apply (for both listing gains & long-term investment).

⚠️ Disclaimer

This blog is for educational purposes only. IPO investing carries market risks. Please consult your SEBI-registered financial advisor before making investment decisions.

📞 Contact Best Technical Share Training Institute

👨🏫 Mentor: Sahil Goyal (Award-Winning Market Analyst, 18+ Years of Experience)

🌐 Official Website: https://technicalsharetraining.com/

📝 Mentor’s Blog: https://sahilgoyal.blog/

📞 Call Now: +91 9013612668

📍 Institute Location (Google Verified): https://share.google/YA0YzheIYidEIn7iE

✅ Google’s #1 Rated Share Market Coaching in Ghaziabad, Noida & Indirapuram

✅ Trusted Since 2008 – 15,000+ Students Trained

✅ Award-Winning Institute: Best Market Analyst Award 2011, 2023, 2025