NTPC Green Energy IPO: Everything You Need to Know

The NTPC Green Energy IPO is a book-built issue valued at ₹10,000 crore, featuring a fresh issue of 92.59 crore shares. If you are looking to invest in the renewable energy sector, this IPO offers a unique opportunity to become part of a leading player in the market.

NTPC Green Energy IPO Overview

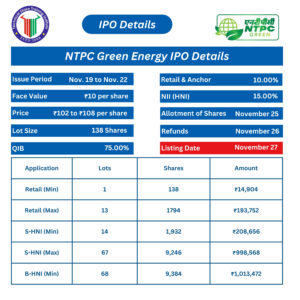

- IPO Date: November 19, 2024, to November 22, 2024

- Issue Type: Book-built issue

- IPO Size: ₹10,000 crore

- Face Value: ₹10 per share

- Price Band: ₹102 to ₹108 per share

- Lot Size: 138 shares

Important Dates

| Event | Date |

|---|---|

| IPO Open Date | Tuesday, November 19, 2024 |

| IPO Close Date | Friday, November 22, 2024 |

| Basis of Allotment | Monday, November 25, 2024 |

| Initiation of Refunds | Tuesday, November 26, 2024 |

| Credit of Shares to Demat | Tuesday, November 26, 2024 |

| Listing Date (BSE, NSE) | Wednesday, November 27, 2024 |

NTPC Green Energy IPO Details

- Minimum Lot Size for Retail Investors: 138 shares (minimum investment of ₹14,904).

- sNII (Small Non-Institutional Investors) Minimum Lot Size: 14 lots (1,932 shares), totaling ₹208,656.

- bNII (Big Non-Institutional Investors) Minimum Lot Size: 68 lots (9,384 shares), totaling ₹1,013,472.

About NTPC Green Energy Limited

Incorporated in April 2022, NTPC Green Energy Limited is a wholly-owned subsidiary of NTPC Limited, a well-known name in India’s energy sector. This renewable energy company focuses on developing projects through both organic and inorganic growth strategies.

- Operational Capacity (as of August 31, 2024): 3,071 MW of solar projects and 100 MW of wind projects spread across six states.

- Project Portfolio (as of June 30, 2024): 14,696 MW, including 2,925 MW of operational projects and 11,771 MW of contracted and awarded projects.

- Ongoing Projects: The company is working on 31 renewable energy projects across seven states with a total capacity of 11,771 MW.

Competitive Strengths

- Promoter Strength: NTPC Green Energy is promoted by NTPC Limited, known for its extensive experience in large-scale project execution, strong relationships with offtakers and suppliers, and significant financial strength.

- Extensive Portfolio: As of June 2024, the company had a project portfolio of 14,696 MW across solar and wind energy.

- Expert Team: The company has an experienced team specializing in renewable energy project execution. As of June 30, 2024, the company employed 234 individuals and utilized 45 contract laborers.

Objects of the Issue

The proceeds from the NTPC Green Energy IPO will be used for the following purposes:

- Investment in the Wholly Owned Subsidiary: Funds will be invested in NTPC Renewable Energy Limited (NREL) for the repayment/prepayment (in full or part) of certain outstanding borrowings.

- General Corporate Purposes: A portion of the funds will be allocated for general corporate needs.

Conclusion and Investment Strategy

NTPC Green Energy Limited is a leading player in renewable power generation, with assets in solar and wind power and plans to diversify further into hydroelectric power and energy storage solutions. While the company has shown net profitability in recent financial reports, it is essential to note that the IPO is aggressively priced based on FY25 annualized earnings.

Investment Recommendation: This IPO is well-suited for well-informed and cash-surplus investors who are willing to park their funds for the long term. As a pure long-term bet, NTPC Green Energy presents an opportunity to capitalize on the growth trajectory of India’s renewable energy sector.

Disclaimer: Investors are advised to consider their financial goals, risk appetite, and conduct due diligence before investing.